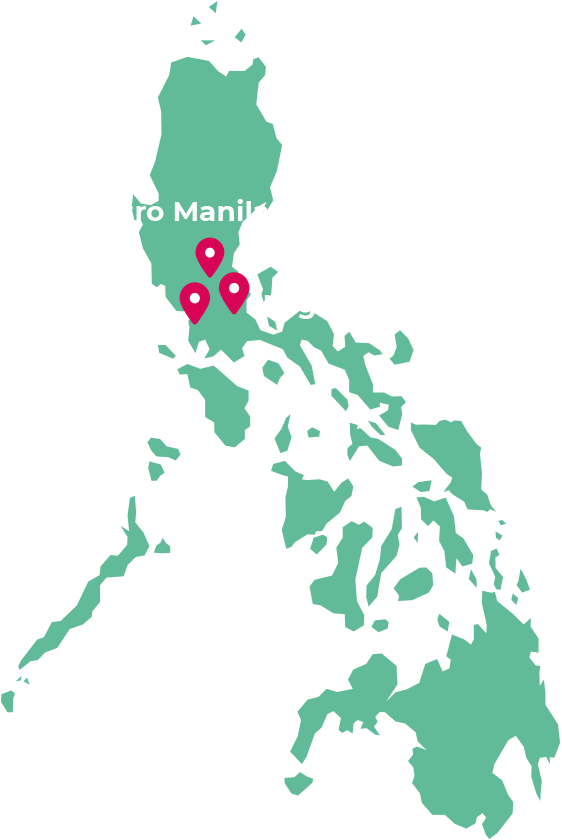

The Philippines has a young population, with a median age of 26.3 and are heavy users of technology. 82% of Filipinos have social media and their average daily use is over 4 hours which is 60% higher than the rest of the world. The Philippines has a GDP of 508 billion USD growing by 6.2% in 2025, making it an attractive region for technology investment.

Evolution is taking advantage of the tremendous potential of the Philippines by working with our partner, Citicore Renewable Energy, "CREC". They will supply 24/7 renewable power to our project, without reliance on carbon credits, priced significantly below the prevailing market rate. We are able to achieve this through the unique synergies we benefit from with our joint venture partner Megawide, being Citicore’s sister company.

The Philippines energy market has unique characteristics for data centre customers:

With a GDP of 506 billion USD, Thailand is a dynamic market in Southeast Asia. The population is very technology focused, with 85% using the internet and averaging over 2.5 hours per day on social media.

In Thailand, Evolution partnered with BanpuNext in March 2024 to deliver smart energy solutions.

Historically Thailand has operated a regulated power market, limiting access to renewable power for consumers. Regulatory changes proposed in response to the growth of cloud and data centre activities in Thailand will introduce a direct PPA programme to Thailand for the first time. This gives Evolution the opportunity to be among the first companies in the country to buy renewable power direct from source.

Vietnam has a relatively young population with a median age of 32. 71% of the population uses the internet, with an average of 2.5 hours per day spent on social media. The country is one of the fastest-growing digital economies in Southeast Asia and on track to reach an internet economy worth $57 billion by 2025. This clearly demonstrates the growing demand for data centre infrastructure in the region.

Vietnam leads ASEAN in renewable energy generation, accounting for roughly two-thirds of the region's solar and wind output and with abundant hydropower.

In Vietnam, Evolution has partnered with BanpuNext in March 2024 to deliver smart energy solutions.

There are promising indicators of access to direct PPAs to buy renewable power direct from source, and Evolution is watching developments closely.